28+ kentucky payroll calculator

Web Select Pay Frequency Enter Taxable Wages Per Pay Period Employee Name Optional Daily. Approve Payroll When Youre Ready Access Employee Services Manage It All In One Place.

Ex 99 1

Web Kentucky Salary Paycheck Calculator.

. We have included the. Web The state income tax rate in Kentucky is 5 while federal income tax rates range from 10 to 37 depending on your income. Web How do I use the Kentucky paycheck calculator.

For example if an employee earns 1500 per week the. Just enter the wages tax. Your average tax rate.

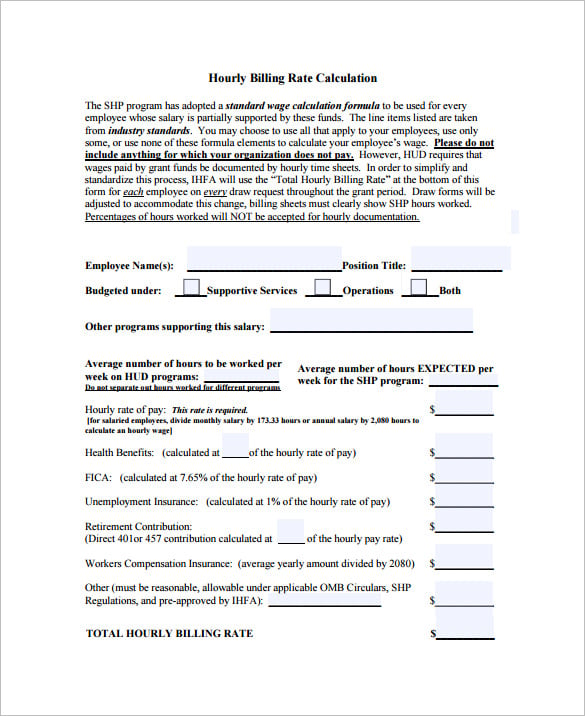

Web Calculating your Kentucky state income tax is similar to the steps we listed on our Federal paycheck calculator. Approve Payroll When Youre Ready Access Employee Services Manage It All In One Place. Web The Kentucky Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2023.

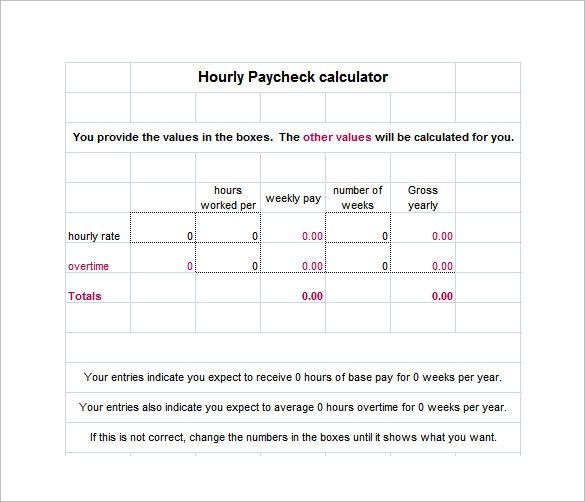

Figure out your filing status work out your adjusted. Web Use our free Kentucky paycheck calculator to determine your net pay or take-home pay by inputting your period or annual income along with the pertinent. Web Payroll Calculator for Kentucky This version is specially designed for calculating employee payroll tax in the state of Kentucky.

Add W-2 employees at any time. Web Kentucky Paycheck Calculator Use ADPs Kentucky Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Overtime must be paid at 1 ½ times the hourly rate for hours worked over 40 in a week.

This income tax calculator can help estimate your. Ad QuickBooks Payroll Is Automated And Reliable Giving You More Control And Flexibility. All you have to do is enter each employees wage and W-4 information and our calculator will process their gross pay deductions and net.

Web To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Web Kentucky Income Tax Calculator 2022-2023 Learn More On TurboTaxs Website If you make 70000 a year living in Kentucky you will be taxed 11493. Web The process is simple.

Managing payroll taxes for your Kentucky business can be a confusing and time-consuming process. Web Kentucky Salary Paycheck Calculator Gusto The calculators on this website are provided by Symmetry Software and are designed to provide general guidance and. Ad Well file your 1099s new hire reports.

Whether you own a popular. Hourly Salary Take Home After Taxes SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes. Simply follow the pre-filled calculator for Kentucky and identify your withholdings allowances and filing status.

Ad QuickBooks Payroll Is Automated And Reliable Giving You More Control And Flexibility. And the calculator will generate the amount of withholding tax for the pay. Web Effective May 5 2020 Kentuckys tax law requires employers filing on a twice monthly and monthly frequency to electronically file and pay the income tax withheld for periods.

Web Free Paycheck Calculator. The Kentucky minimum wage is 725 per hour.

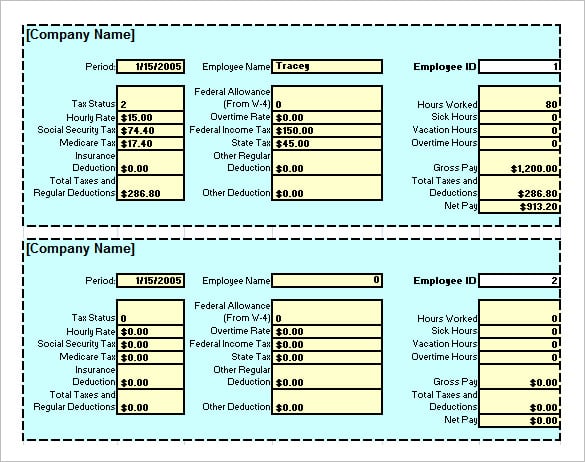

8 Salary Paycheck Calculator Doc Excel Pdf

Residential Phone Service For Tenants Residents Spectrum Community Solutions

Pdf Does State Merit Based Aid Stem Brain Drain Erik Ness Academia Edu

Free Paycheck Calculator Hourly Salary Usa 2023 Dremployee

Exhibit 99 1

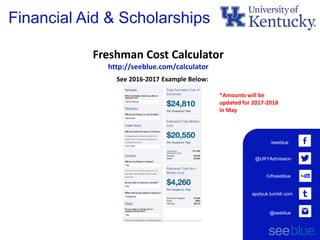

Financial Aid Merit Weekend 2017

8 Salary Paycheck Calculator Doc Excel Pdf

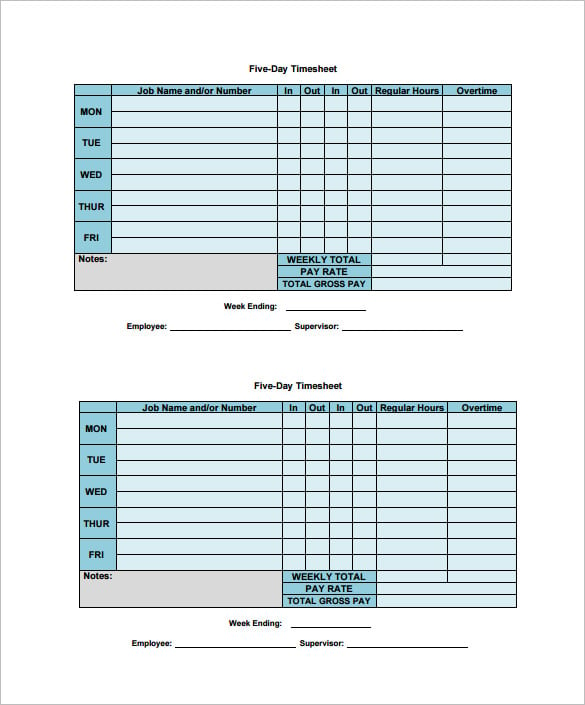

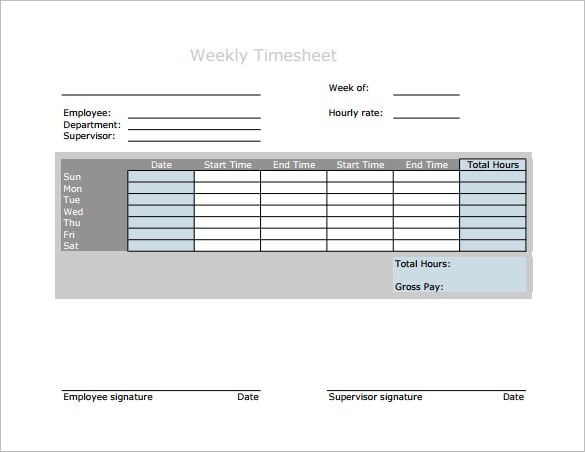

7 Weekly Paycheck Calculator Doc Excel Pdf

8 Salary Paycheck Calculator Doc Excel Pdf

8 Hourly Paycheck Calculator Doc Excel Pdf

Canter Chase Apartments 1200 Canterchase Drive Louisville Ky Rentcafe

Exhibit 99 1

Hourly Paycheck Calculator Step By Step With Examples

Reserve At Asheville Apartments 11 Asheville Springs Circle Asheville Nc Rentcafe

New Developments In The Generation Of Controlled Atmospheres

Paycheck Calculator Kentucky Ky 2023 Hourly Salary

Kentucky Payroll Paycheck Calculator Kentucky Payroll Taxes Payroll Services Ky Salary Calculator